College of Law organizes and leads panel of tax experts including officials from the QFC and IMF

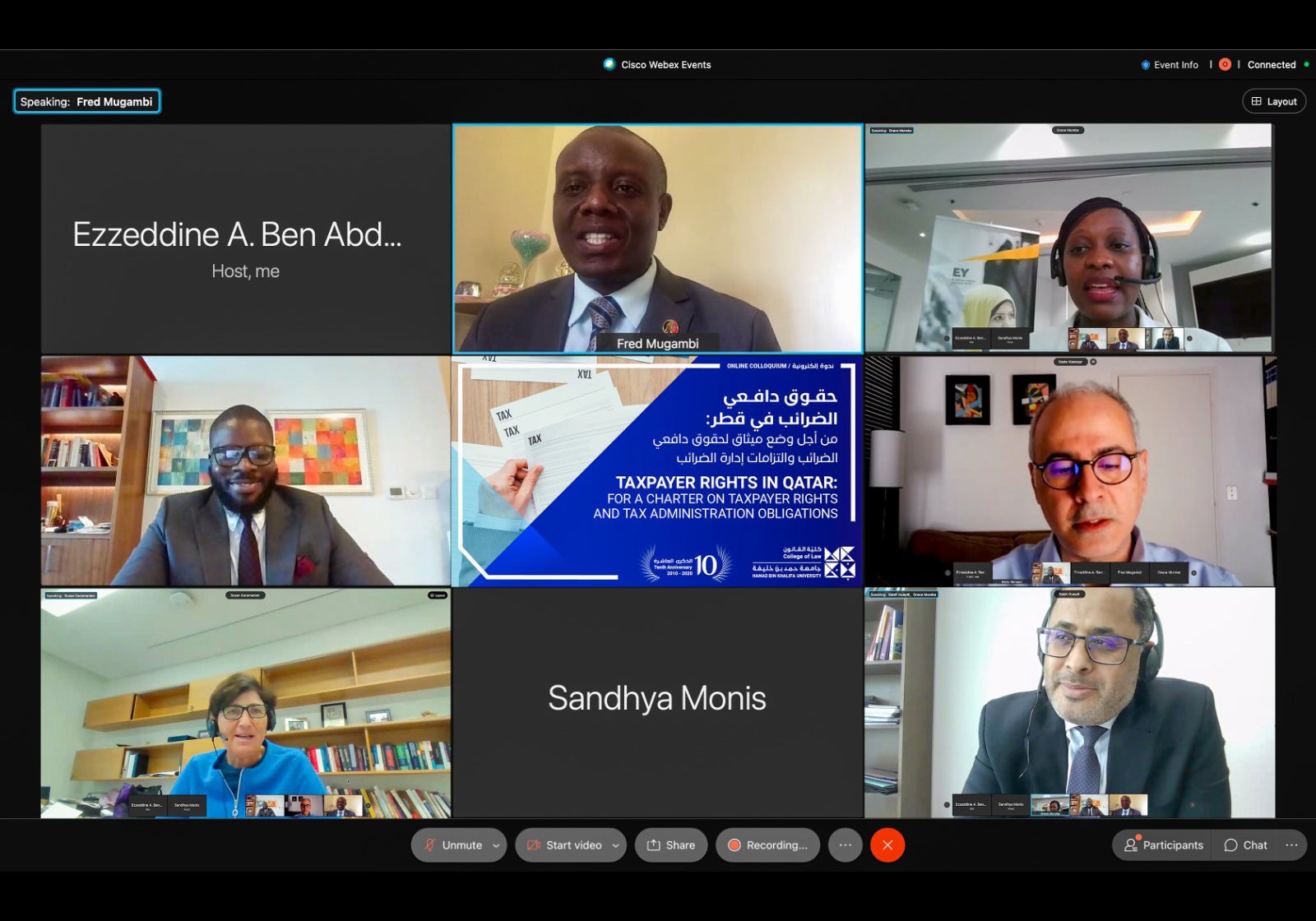

A recent tax colloquium organized by the College of Law at Hamad Bin Khalifa University (HBKU) was the platform to discuss a charter on taxpayer rights and tax administration obligations for Qatar. The event took place online with participation by the International Monetary Fund (IMF), Qatar Financial Centre (QFC) Authority, Ernst and Young Qatar, and the Kenya Revenue Authority (KRA).

The colloquium brought speakers together to review the ‘Charter for QFC Taxpayers’, which the QFC has introduced for QFC-licensed firms and the Charter published by Qatar’s General Tax Authority (GTA). This was with a view to better understanding how their implementation, successes, and limitations could inform the process of further developing publicly available and acceptable taxpayer rights, applicable to all taxpayers in Qatar.

Dr. Alexander Paul Ezenagu, assistant professor at the College of Law, HBKU, chaired the panel discussion in which Mr. Salah Gueydi, director of tax, QFC, and Ms. Grace Murakha, tax manager, Ernst & Young Qatar, gave a comprehensive overview of Qatar’s tax regimes. The panel also featured Mr. Mario Mansour, director of the Middle East Regional Technical Assistance Centre, IMF; and Dr. Fred Mugambi Mwirigi, Commissioner and head of the Kenya School of Revenue Administration (KESRA), KRA.

The speakers highlighted evidence from several other jurisdictions, which reveal that countries that have enacted charters generally witness voluntary tax compliance, effective tax administration, and reduced cost of enforcement, among other benefits. This is especially important given that taxation plays an integral role in the sustainable development of states. They also shared their views on what an acceptable ‘charter on taxpayers rights’ looks like and the processes to successfully enacting one.

Speaking after the event, Dr. Ezenagu said: “The prospect of a taxpayer charter has arisen in an academic context as part of the research and teaching HBKU faculty engage in at the College of Law. The colloquium put the topic firmly into its applied context and we had very fruitful discussions with speakers from the QFC and IMF, and other jurisdictions like Kenya’s Tax Revenue Authority, who have practical, hands-on engagement. Though we discussed what an acceptable ‘charter on taxpayers rights’ looks like, a first step to publishing and enforcing a charter is agreeing on the rights and obligations of taxpayers and tax administrators, and we look forward to expanding on that during our next colloquium.”

The College of Law regularly holds events that showcase its research interests and activities. For more information please visit cl.hbku.edu.qa.

Related News

HBKU Hosts Global Conference on Investment Promotion and Sustainable Development

HBKU UNESCO Chair on Environmental Law Supports Regional Dialogue at 6th MENA Environmental Law and Policy Scholars’ Conference