Discussions consider whether Qatari financial institutions are ready to embrace FinTech

The 6th CEOs and Islamic Finance Leaders Roundtable (CIFLR) was organized by the Center for Islamic Economics and Finance (CIEF) at the College of Islamic Studies (CIS), Hamad Bin Khalifa University (HBKU), on January 12. The event is the latest edition of the annual series which has been regularly held since the launch of this platform in 2015, as part of CIS’ intellectual contribution towards Qatar’s commitment to economic diversification. The CIFLR aims to create a junction for the exchange of firsthand information from stakeholders and practitioners in the finance industry, on one side, and for sharing the latest scientific knowledge, on the other, to develop the synergies between experts in the field and thought leaders from the world of academia.

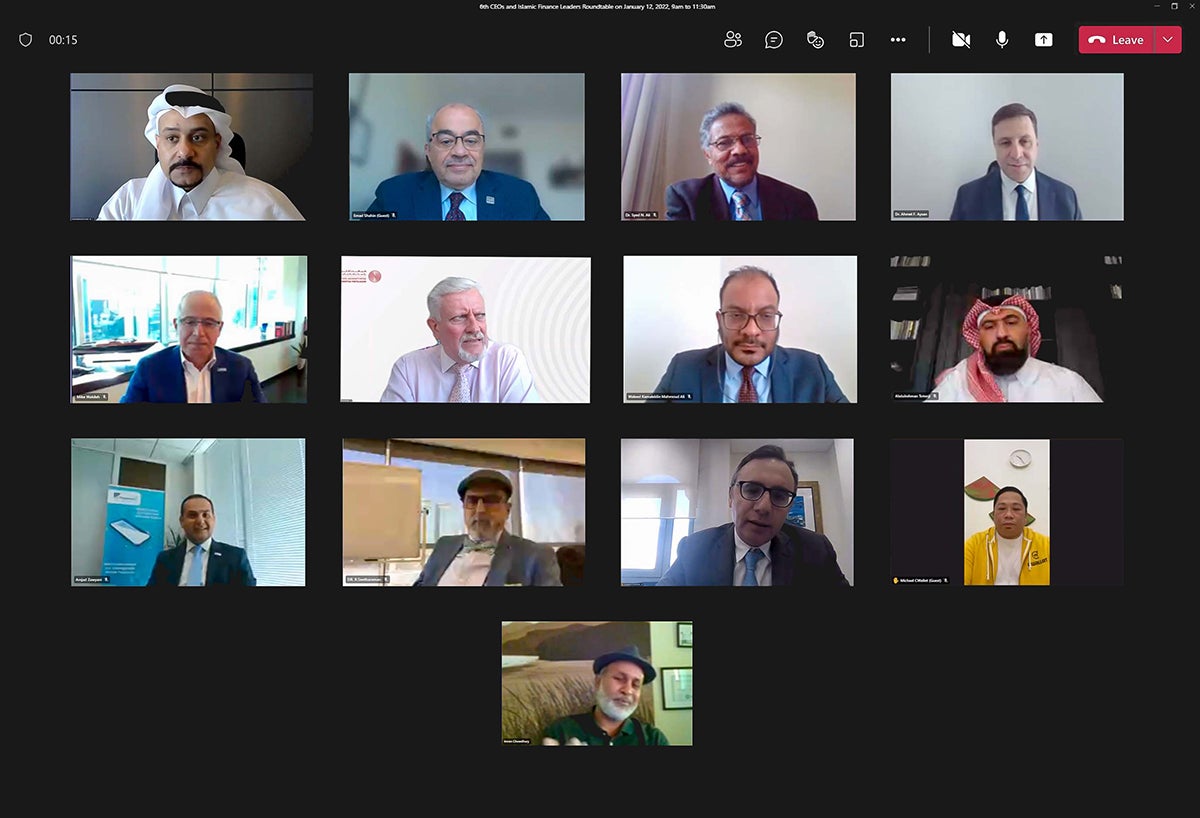

This year, the event was held virtually and witnessed by more than 100 participants from the selected elite group of Islamic finance leaders, decision-makers, representatives of ministries, CEOs, regulators, academic thought leaders, and students. The 6th CIFLR was moderated by Dr. Ahmet Aysan, Professor and Coordinator of the Islamic Finance programs at CIS, and aimed to advance the Qatar National FinTech Strategy and Qatar National Vision 2030 by fostering an open dialogue among the participants and providing an opportunity for student engagement with the industry.

Under the theme “Digital Transformation Enablers and Prospects: Are Qatari Financial Institutions Ready to Embrace Fintech?”, the roundtable began with the introductory remarks of Dr. Syed Nazim Ali, Director of CIEF. Dr. Emad El-Din Shahin, Dean of CIS, said: “The discussions refined our understanding of on the ground realities and challenges and helped further to expedite the enablers of FinTech digital transformation, while reducing the barriers to it and encouraging a more robust economy that meets the needs of all segments of society and promotes Qatar to become the financial hub in the Middle East.”

Yousuf Al-Jaida, CEO of the Qatar Financial Centre (QFC), in his keynote address, summed up the significant progress Qatar has made in structuring and developing a sustainable and globally competitive FinTech ecosystem since the formation of the Qatar National FinTech Taskforce in 2017. He also highlighted the present asset size of Islamic Finance which reached $3.7 trillion by the end of 2021 while Islamic FinTech assets reached $49 billion by the end of 2020, with a forecast to reach $128 billion by 2022 at the growth rate of 21% CAGR. He identified environmental, social, and governance (ESG)-aimed finance and COVID-19 restrictions to physical interactions among the enablers of FinTech. He expressed his support to Qatar’s commitment to the National FinTech Strategy to diversify its economy that was effectively commenced with the establishment of the Qatar FinTech Hub (QFTH) in April 2020. He stated QFC’s commitment in making Qatar the hub of Islamic FinTech, and an important FinTech center in general.

Dr. R. Seetharaman, CEO of Doha Bank Group, briefed participants on the building blocks of digital transformation in financial intermediation in the first discussion. He stressed that the entire field, not only financial intermediation, is undergoing a great transformation and technology is the primary enabler. He further asserted that financial institutions worldwide are realizing that they need to focus on a different sort of innovation, better technology, modernized infrastructure, and improved customer experience.

Dr. Aysan mentioned that the latest market research reports define the FinTech ecosystem in five areas: human capital, regulation, financial capital, physical capital (infrastructure), and demand. In addition, a participant highlighted that 90% of financial intermediation in Qatar is conducted through banks and significant potential can be noted in establishing ‘digital banks,’ ‘crowdfunding,’ and providing ‘regulatory sandboxes’ through RegTech. Islamic bank representatives further supported the idea of regulatory sandboxes and asserted that “although Islamic banks may face difficulty in embracing FinTech, huge potential lies in the automation of Shari’a compliance.”

The event concluded with remarks from the organizers that the transition to a post-pandemic ‘new normal’ by many world economies is creating new opportunities for FinTech development worldwide, since it not only simplifies the process of financial transactions but also reduces transaction cost substantially.

The College of Islamic Studies regularly hosts public lectures and conferences to promote a deeper understanding of the various aspects of Islam among the wider community. Industry-relevant and rich discussions directly interact with the Islamic finance programs being offered at master’s and PhD levels at CIS.